how long can you go without paying property taxes in missouri

If the auctioned property is a homestead--meaning it was the primary place of residence for the owner--the owner can buy back his tax deed within two years from the date of. Consider these five ways to avoid spiking into a higher tax rentals.

Fill Free Fillable Forms For The State Of Missouri

How to Redeem the Property.

. How Long Can You Go Without Paying Property Taxes In Missouri. A tax sale must happen within three years though state law permits an earlier sale if the taxes are delinquent. Counties in mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year.

At What Age Do You Stop Paying Property Taxes In Missouri. In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on property once 35 days have passed after a final bill is sent to the homeowner. What is a personal property tax waiver.

In some cases taxing authorities will honor a January postmark but its best not to take the chance. Missouris residency requirement extends to one calendar year. If you live in a county with 3000000 or more residents youll have to pay the taxes special assessments interest and costs due.

How long can you go without paying property taxes in Arizona. The homeowner doesnt have to wait long for redemption if the home has been sold once on the first two properties. Property sold at the tax sale may be redeemed up to 3 years from the date of recordation.

If a property is delinquent for 3 years it is placed on a Delinquency List that is sent to the State of New Mexico Property Tax Division in July of each year. For most jurisdictions property taxes are due by January 31. In Missouri you can ordinarily redeem your home within one year after the tax sale and up until the purchaser gets the deed to your homeif the property sells.

For example you could inherit property from an heir in one of the six states that do impose an inheritance tax like Kentucky. If the taxes remain unpaid after two years the treasurers auction off those liens to investors who then pay the delinquent tax recouping money the. Then youd need to pay that inheritance tax.

Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest and other charges. How long can you go without paying property taxes in Georgia. If your home is sold for tax purposes you may redeem your home during the redemption period if the homeowner has the right to reside there.

A tax waiver also known as Statement of Non-Assessment indicates a specific person business or corporation does not owe any personal property taxes for a specified tax year. In each county the length of this period will vary. How Long Can You Go Without Paying Property Taxes In Missouri.

Taxes must be paid by that date so on February 1 all unpaid taxes are seen as delinquent. It depends on the county how long this period lasts. The number of years required for a Missouri period typically lasts 12 months.

At any time on or before the business day immediately before the sale you can pay the taxes and costs due which will stop the sale. Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. Due dates for inheritance taxes vary by state.

As for property taxes the homeowner forfeits the property to the agency in the second year of a tax delinquency. How Long Can You Go Without Paying Property Taxes In Missouri. A 5 penalty and 1 interest charge per month will apply.

How long can you go without paying property taxes in New Mexico. It turns out that you can avoid paying taxes if you understand some of the ins and outs of the tax code. Eligible for social security benefits when they are over 60 years of age as well as their spouses and.

If you dont pay the tax lien off within 12 months in Georgia then the lienholder has the right to foreclose on the property and receive title and you lose ownership of the property. How Long Can You Go Without Paying Property Taxes In Missouri. The original owner of the property can repay the investor for the total amount of money spent at the auction plus 25 percent in penalties and re-acquire legal ownership.

When a property owner falls behind on paying taxes county treasurers place liens on properties with delinquent property taxes. The homeowner only has 90 days to redeem the property if the property has sold on the third or subsequent sale. As of 1993 Missouri has a one-year restriction period.

Anderson said that the owner had to pay him 100 a year for the use of the building. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft. ECheck - You will need your routing number and checking or savings account number.

The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or eCheck. For the entire 2012 calendar year an individual must be a resident of Missouri. In Missouri a tax sale will typically take place if you dont pay the property taxes on your home for three years.

In some counties the period may be one year. Another example of when you may want to pay someone elses taxes is if you inherited a property and the property is going through probate which can be a long process in some states. In Missouri Missouri state law clearly states that cars motorcycles trucks and boats require property tax payment.

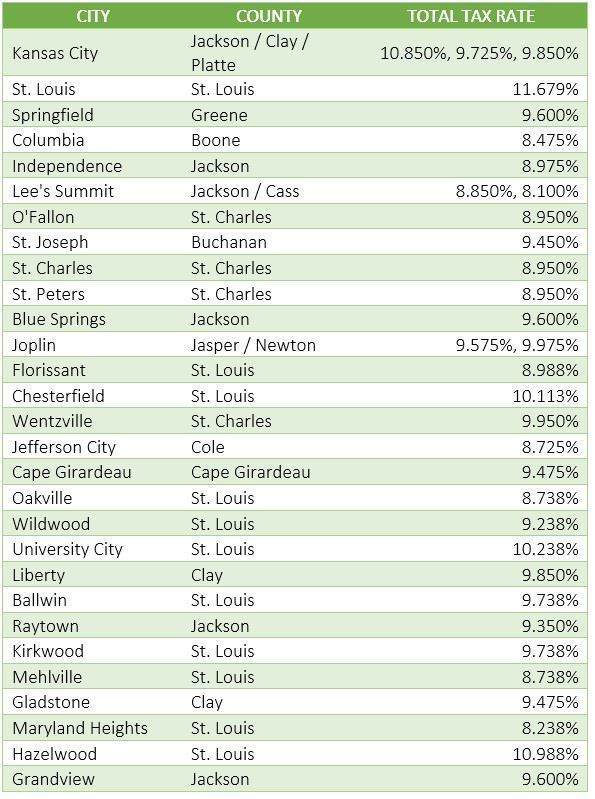

A person or couple is not allowed to rely solely on someone else and must be over 65 years of age. Missouri Property Tax Rates The states average effective property tax rate is 093 somewhat lower than the national average of 107. Rates in Missouri vary significantly depending on where you live though.

Federal estate tax An estate could subject to the federal estate tax if its more than 1158 million. 140150 140190. You can always mail your tax payment or go into the tax assessors thereafter taxes are due annually as long as you own the property.

The owner must contact the Lafourche Parish Sheriffs Office to redeem the property. If you fail to pay your Louisiana property taxes you may lose your property or part of it to a tax sale.

Missouri Income Tax Rate And Brackets H R Block

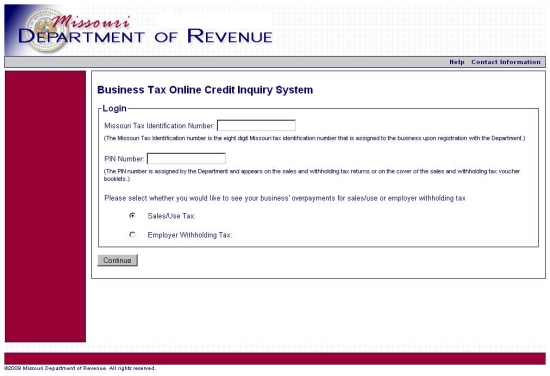

Sales Use Tax Credit Inquiry Instructions

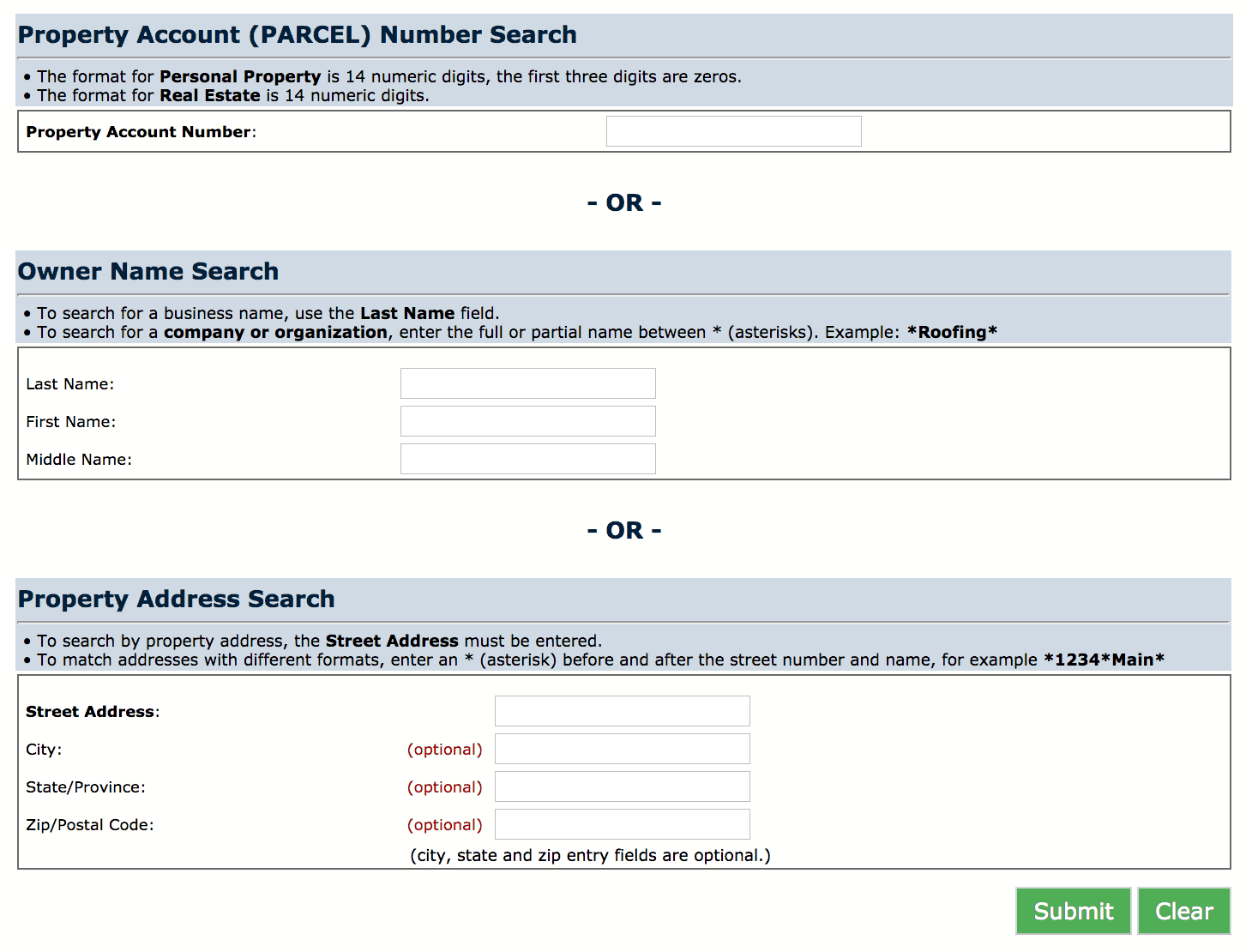

How To Use The Property Tax Portal Clay County Missouri Tax

Missouri Property Tax H R Block

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Tax Forms

Sales Use Tax Credit Inquiry Instructions

Sales Use Tax Credit Inquiry Instructions

Missouri Estate Tax Everything You Need To Know Smartasset

Missouri Sales Tax Small Business Guide Truic

Pay Property Taxes Online Jackson County Mo

Fill Free Fillable Forms For The State Of Missouri

Pin On Politics In The Early 1900s

Missouri Sales Tax Guide For Businesses

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

Personal Property Tax Jackson County Mo

Find Homes For Sale Market Statistics Foreclosures Property Taxes Real Estate News Agent Reviews Condos Find Homes For Sale Real Estate News Property Tax